1098T

The University will be mailing to eligible students their IRS Form 1098-T by January 31st. The form is mailed to a student’s “permanent address” as indicated in the self-serviced portal (Banner). You may also access your 1098-T by logging on to the MAXIMUS TRA SERVICES secure website at https://tra.maximus.com/traPortal/Login. If you are a first time user, click on "Register" and follow the instructions. If you have a name change from the prior year, you may need to create a new account to see the current 1098T. For TRA website assistance, you may call the Maximus TRA Services Help Desk at (833) 604-9184, available from 10:00 AM to 8:00 PM (Eastern Time) Monday through Friday.

The 1098T form alerts students that they may be eligible to claim education tax benefits/credits. While it is a good starting point, the 1098-T, as designed and regulated by the IRS, does not contain all of the information needed to claim a tax benefit/credit on your federal tax return. Claiming education tax benefits is a voluntary decision for those who may qualify. Determination of eligibility for an educational tax credit is the responsibility of the taxpayer.

This information is not intended as legal or tax advice. Individuals should review IRS Publication 970 "Tax Benefits for Higher Education" or contact the IRS or a tax practitioner about personal income tax situations.

1098-T Frequently Asked Questions

On the 1098-T, Yeshiva University reports the following student information to the IRS:

- student’s name and permanent address

- taxpayer identification number

- dollar amount of eligible payments toward qualified transactions

- dollar amount of financial aid credited to your account

- adjustments to transactions reported in prior years

- whether you were a graduate student during the calendar year

- whether you were at least a half-time student during the calendar year

- whether any payment amounts reported pertain to courses beginning in the first quarter of the coming year

YU is required to report all qualified transactions in the calendar year they posted to your account, regardless of the academic period to which they belong. The university cannot modify the reporting method. Use your personal records and student account statements to determine the amounts you actually paid toward the charges reported on the 1098-T.

The IRS requires the University to request your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) annually if it is not recorded on your student account.

You can return the form by:

Preferred Method

Upload the file in Insidetrack (https://insidetrack.yu.edu/).

1) On the left side, go to Students:

2) On the Student Accounts Card click on Upload 1098T W9S forms:

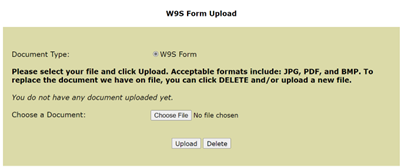

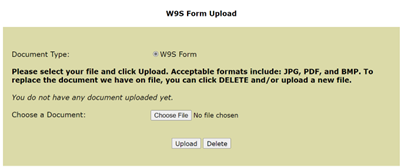

3) Follow instructions to upload your W9S form:

Alternate Methods:

Fax: 212-960-0037

Mail: Yeshiva University, OSF Belfer Hall 1013A, 2495 Amsterdam Avenue, New York, NY 10033

If you received a 1098-T prior to our receiving your W9S, you can go to https://tra.maximus.com to print out a revised copy.

Box 1

IRS regulations require schools to report in Box 1 amounts paid during the calendar year for “qualified tuition and related expenses” (QTRE) that were incurred during the calendar year. This reflects payments received for qualified expenses (generally tuition and required fees) from all sources (including but not limited to loans, scholarships, cash/check/credit card payments, 529 plan payments) during the 2025 calendar year. Box 1 does not include payments for room and board, health insurance, graduation fees, etc. This amount is not reduced by scholarships and grants reported in Box 5. Additional information regarding what qualifies as QTRE can be found on the IRS website.

Box 2 and 3

Reserved by the IRS.

Box 4

Shows adjustments made to qualified tuition and related expenses that were reported in a prior year Form 1098-T. For example, refunds or reimbursements made in 2025 that relate to payments received and reported to the IRS on a Form 1098-T in a prior year. This amount may reduce a tax benefit that you claimed in a prior year. Please consult your tax preparer or the IRS.

Box 5

Shows total scholarships and grants posted to the student account in calendar year 2025. This may affect the amount of an education tax benefit claimed for the year.

Box 6

Shows adjustments to scholarships and grants made during the 2025 calendar year that related to amounts reported on a prior year’s 1098-T. This may affect the amount of an education tax benefit claimed for a prior year, Please consult with your tax preparer or the IRS.

Box 7

Shows whether a portion of the Box 1 reported 2025 payments relate to an academic period that begins in January through March of 2025.

Box 8

Shows whether the student was at least a half-time undergraduate student during any semester that began in 2025.

Box 9

Shows whether the student was enrolled in a program or programs leading to a graduate-level degree, graduate-level certificate, or other recognized graduate-level educational credential.

YU is not required to report 1098-Ts for non-credit programs or for non-resident alien students. International students may request a 1098-T by contacting accounts@yu.edu.

A: There are potentially many reasons for this discrepancy. First, the amount in Box 1 includes payments received from all sources, including financial aid and third-party sponsors. Second, Box 1 only represents amounts paid for qualified tuition and related expenses (QTRE) that were incurred during the calendar year and does not include payments made for room and board, insurance, health service fees, or parking which, though important, are not considered mandatory education expenses for tax purposes. Finally, Form 1098-T reports amounts that the student paid in a certain calendar year, and the pay date does not necessarily correspond to the dates that the classes were attended. For example, tuition for the Spring semester is typically billed in December so a student may have paid tuition for the 2025 Spring semester in 2024 despite the fact that classes didn’t start until 2025.

The IRS is aware of this, see Publication 970 (highlighted text).

The best and most accurate source of information about the amounts that you paid for qualified tuition and related expenses will be your account summary - go to https://insidetrack.yu.edu.

- Under Students, go to the Student Accounts Card

- Click on Account Summary

A: No, amounts paid for books are not included in Box 1 of Form 1098-T. You should consult with your tax advisor to determine if payments for books, equipment or fees should be considered when preparing your income tax returns and determining eligibility for education tax credits or deductions.

A: Typically, charges are posted to your student account in the prior December for the Spring semester and in July for the Fall semester. Box 1 of Form 1098-T reflects payments made during the calendar year for qualified tuition and related expenses that were incurred during the calendar year and it is not based on when the classes were attended or billed to the student account. Your Account Summary in https://insidetrack.yu.edu will show the dates payments were posted to your account and are a valuable resource for determining the semesters that are included in your Form 1098-T.

The best and most accurate source of information about the amounts that you paid for qualified tuition and related expenses will be your account summary - go to https://insidetrack.yu.edu.

- Click on Student Self-Service on the left

- Under Student Accounts, click on Account Summary

Some May 2025 graduates will not be issued a 2025 Form 1098-T because there is a possibility that payments for QTRE for Spring 2025 were made on or before December 31, 2024. If a student paid for the Spring 2025 semester and any other outstanding QTRE charges in calendar year 2024, then the student would not receive a 2025 Form 1098-T.

A: Fellowships/stipends/housing grants or living allowances posted directly to your student account and for which you did not receive a cash/check payment, are considered financial aid and will be reported in Box 5 as scholarships or grants. For any fellowships, stipends, or grants received by check/cash, you will receive a year-end tax letter from Yeshiva’s Tax Office explaining the general tax treatment of such payments. The amounts reported in these letters are in addition to the amounts reported in Box 5 of your Form 1098-T. Please consult your tax advisor regarding the tax treatments of these items as they may be constitute taxable income to you depending on your circumstances.

Scholarships that pay for qualified tuition and related expenses are generally not taxable to the student. However, if any portion of your scholarships paid for non-qualified expenses, for example room and board, then you may be responsible for reporting such portion as taxable income on your tax return. You should consult your tax advisor. For further guidance, please review IRS Publication 970 "Tax Benefits for Higher Education" at the IRS Web site.

The 1098-T form is not meant to be an indicator of income. The form is an informational return for your personal records, and is not required to be submitted with your tax return. IRS Form 1098-T contains information to assist the IRS and you in determining if you are eligible to claim educational related tax credits such as the American Opportunity Credit and Lifetime Learning Tax Credit. Form 1098-T does not indicate whether you received a taxable scholarship or fellowship. It is the sole responsibility of the student to report and pay taxes on the taxable portion of any scholarship, fellowship, or grant that is received. This is not the responsibility of the University. For example, you may need to report taxable income if the total amount of your grants or scholarships received during the year exceeded the amount you paid for qualified education expenses in that year. Please refer to IRS Publication 970 and consult with your tax preparer if you have additional questions regarding how the 1098-T relates to your specific tax preparation

Reporting to the IRS depends primarily on your SSN or ITIN, so it is very important for you to have the correct information on file with the University. If your SSN or ITIN is missing or incorrect, please ASAP complete Part I of Form W-9S, which can be printed from the link here and submit it to the Office of Student Accounts to ensure the data we send to the IRS is accurate. You may have also received an letter from Maximus TRE Services requesting that you complete a Form W-9S.

You can return the form by:

Preferred Method

Upload the file in Insidetrack (https://insidetrack.yu.edu/).

1) On the left side, go to Students:

2) On the Student Accounts Card click on Upload 1098T W9S forms:

3) Follow instructions to upload your W9S form:

Alternate Methods:

Fax: 212-960-0037

Mail: Yeshiva University, OSF Belfer Hall 1013A, 2495 Amsterdam Avenue, New York, NY 10033

The University is not required, by the IRS, to furnish a Form 1098-T in the following instances:

- Payments for courses for which no academic credit is offered, even if the student is otherwise enrolled in a degree program.

- Enrolled student is a nonresident alien, unless requested by the student.

- Students whose qualified tuition and related expenses are entirely waived or paid entirely with grants/scholarships.

- Students for whom you do not maintain a separate financial account and whose qualified tuition and related expenses are covered by a formal billing arrangement between an institution and the student's employer or a governmental entity, such as the Department of Veterans Affairs or the Department of Defense.

For more information, go to IRS Higher Education Emergency Grants Frequently Asked Questions

I am a student who received an emergency financial aid grant under section 3504, 18004, or 18008 of the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic. Is this grant includible in my gross income? (FAQ updated by the IRS on May 18, 2021)

No. Emergency financial aid grants under the CARES Act for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic, such as unexpected expenses for food, housing, course materials, technology, health care, or child care, are not included in your gross income.

I am a student who received an emergency financial aid grant under section 314 of the CRRSAA (HEERF II) or section 2003 of the ARPA (HHERF III) for a component of the cost of my attendance or for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic. Is this grant includible in my gross income? ( FAQ added by the IRS May 18, 2021)

No. Emergency financial aid grants under the CRRSAA or the ARP for a component of the cost of your attendance or for unexpected expenses, unmet financial need, or expenses related to the disruption of campus operations on account of the COVID-19 pandemic, such as food, housing, health care (including mental health care), or child care, are not included in your gross income.

I am a student who received an emergency financial aid grant from a Federal agency, State, Indian tribe, institution of higher education, or scholarship-granting organization (including a tribal organization) because of an event related to the COVID-19 pandemic. Is this grant includible in my gross income? (FAQ added by the IRS May 18, 2021)

No. Emergency financial aid grants made by a Federal agency, State, Indian tribe, institution of higher education, or scholarship-granting organization (including a tribal organization) because of an event related to the COVID-19 pandemic are not included in your gross income.

I received an emergency financial aid grant as described in the questions above and used some of it to pay for course-related books, supplies, and equipment that are now required for online learning because my college or university campus is closed. The books, supplies, and equipment do not have to be purchased from my college or university. Can I claim a tuition and fees deduction for these expenses, or treat the cost of these items as a qualifying education expense for purposes of claiming the American Opportunity Credit or the Lifetime Learning Credit? (FAQ added by the IRS May 18, 2021)

You may claim the American Opportunity Credit for these expenses if you otherwise meet the requirements for the credit. You cannot claim a Lifetime Learning Credit or a tuition and fees deduction for the expenses because you are not required to purchase the books, supplies, and equipment from your college or university. For additional information on these credits and the tuition and fees deduction, see Publication 970, Tax Benefits for Education, available on IRS.gov/pub970.

I received an emergency financial aid grant as described in the questions above and used some of it to pay for course-related books, supplies, and equipment that are now required for online learning because my college or university campus is closed. The books, supplies, and equipment must be purchased from my college or university. Can I claim a tuition and fees deduction for these expenses, or treat the cost of these items as a qualifying education expense for purposes of claiming the American Opportunity Credit and the Lifetime Learning Credit? (FAQ added by the IRS May 18, 2021)

You may claim the American Opportunity Credit or the Lifetime Learning Credit for these expenses if you otherwise meet the requirements for the credit you are claiming. In addition, if you do not claim one of the credits, you can claim a deduction for tuition and fees for these expenses paid on or before December 31, 2020. The tuition and fees deduction is not available for tax years beginning after December 31, 2020.

Do higher education institutions have any requirements under Internal Revenue Code section 6041 to report information on Form 1099-MISC for emergency financial aid grants awarded to students under HEERF I, HEERF II or HEERF III ? (FAQ added by the IRS May 18, 2021)

No, higher education institutions do not have information reporting requirements under section 6041 with respect to the emergency financial aid grants. These grants are not included in students' gross income, as described in A1, A2, and A3 above. Because the grants are not income, section 6041 does not apply to them, and higher education institutions are not required to file or furnish Forms 1099-MISC, Miscellaneous Income, reporting the emergency financial aid grants.

For tax year 2021, do higher education institutions have any requirements under Internal Revenue Code section 6050S to report information on Form 1098-T for emergency financial aid grants awarded to students under HEERF I, HEERF II or HEERF III ? (FAQ added by the IRS May 18, 2021)

Yes, for tax year 2021, in certain cases, higher education institutions have information reporting requirements under section 6050S for payments made with emergency financial aid grants. As described in the questions above, a student may claim a deduction or one of the education credits if the student and the expenses otherwise qualify for the deduction or credit. Any amounts that qualify for the deduction or credit are known as “qualified tuition and related expenses” (QTRE) and trigger the reporting requirements of section 6050S. Accordingly, higher education institutions must report total QTRE, including QTRE paid with emergency financial aid grant funds, in Box 1 of Form 1098-T, Tuition Statement. Higher education institutions do not need to separately identify the portion of QTRE paid with the emergency financial aid grants anywhere on Form 1098-T and they do not need to report the grants themselves in Box 5 of Form 1098-T. This is the case regardless of whether the higher education institution paid the emergency financial aid grants to the students, who then used grant money to pay for QTRE or applied grant money directly to a QTRE on a student’s account.

Yeshiva University does not provide legal and/or tax advice. The above is provided for informational purposes only. For tax advice on your specific situation, contact the IRS or a tax professional.